Title: Checking accounts affect on credit:

What Impact Will a Checking Account Have on Your Credit?

The state of your credit has a big impact on your financial situation. Your credit score may affect your eligibility for certain professions and housing options as well as your ability to receive credit cards and loans. It should come as no surprise that a variety of financial decisions, including borrowing money or applying for a credit card, can affect your credit rating. But how about something as apparently straightforward as creating a checking account? Does it affect your credit in any way? This article will go into the elements that can impact your credit score and examine the connection between opening new checking accounts and credit.

Fundamentals of Credit Scores

Let’s quickly recap what credit ratings are and why they matter before getting into the effects of opening a checking account.

Definition of Credit Score: Your creditworthiness is represented by a three-digit number known as your credit score. It is used by lenders, landlords, and even employers to determine your propensity to repay loans or fulfil financial commitments. FICO® and Vantage Score, the two most popular credit scoring models, both use data from your credit reports to determine your score.

Credit Reporting Bureaus: Equifax, Experian, and TransUnion are the three main credit reporting agencies that keep a record of and manage your credit history. To construct your credit report, these bureaus gather information from a variety of sources, including lenders, creditors, and public records.

After learning the fundamentals of credit scores, let’s investigate how opening a checking account may affect them.

Do Checking Account Openings Affect Credit?

Typically, opening a checking account has no immediate impact on your credit score. A checking account is mainly a tool for managing your finances rather than a type of credit in and of itself. As a result, it differs from taking out a loan or using a credit card in that it doesn’t involve borrowing money or amassing debt. As a result, opening a checking account alone has no impact on your credit score and is not reported to the main credit bureaus.

However, there are several circumstances and behaviors involving checking accounts that can have an indirect effect on your credit.

Protection from overdrafts and credit lines

Overdraft protection and overdraft lines of credit are optional features offered by some checking accounts. When you don’t have enough money in your account to cover a transaction, overdraft protection is there to protect you. If you overdraw your account, the bank may lend you the money you need; however, this money will normally need to be paid back with interest or a fee.

Overdraft protection and credit lines can have the following effects on your credit:

Credit Check: In order to determine your creditworthiness when you ask for overdraft protection or an overdraft line of credit, the bank may run a “hard inquiry” or “hard pull” on your credit report. This investigation may temporarily lower your credit score by a few points, which is a minimal negative effect on your score.

Credit Utilization: The outstanding balances may have an impact on your credit utilization ratio if you frequently utilize overdraft protection or rely on an overdraft line of credit. Your credit score is heavily influenced by your credit utilization, and a high utilization rate (using a sizable amount of your available credit) can be detrimental to your credit.

Payment History: It’s crucial to refund overdraft balances and credit line payments on time. Your credit history may be negatively impacted by late or missed payments that are reported to the credit bureaus.

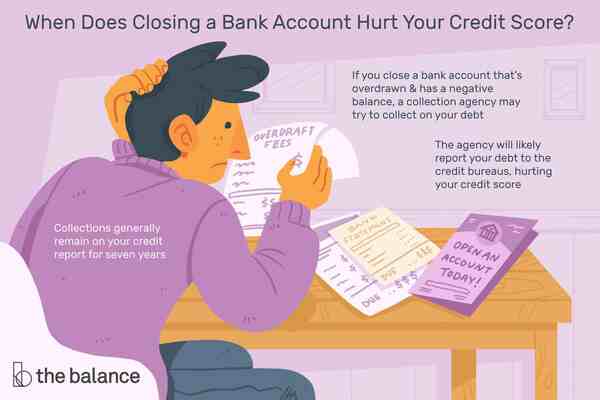

Negative Balances and Overdrafts

Although the act of overdrawing your checking account is not itself reported to the credit agencies, the results of doing so may nonetheless have an indirect negative impact on your credit:

Bank Reporting: The bank may shut your account and turn over the debt to a collection agency if you overdraw your account and don’t promptly make up the negative balance. Your credit could be severely harmed if the credit bureaus receive a report on this collection account.

Chex Systems: Some banks track a person’s checking account history using this consumer reporting organization, just like credit agencies do with credit histories. It may be more difficult for you to create a new checking account in the future if Chex Systems receives a report of previous overdrafts or negative balances.

Checking accounts held jointly

Your credit score is unaffected when you open a joint checking account with a spouse or family member, for example. Although they are a practical way to handle shared resources, joint checking accounts are not a type of credit or debt.

However, it’s critical to be aware that any financial activity within the joint account could, if it results in problems like overdrafts, negative balances, or unpaid obligations, indirectly impact the credit of both account holders. To avoid any negative effects, it is essential to share a checking account and practice appropriate money management.

Keep an eye on Your Credit

Opening a checking account won’t raise your credit score directly, but it’s still important to monitor your credit report for any errors or potential problems that might result from your banking actions. Through AnnualCreditReport.com, you can yearly request free copies of your credit reports from all three major credit bureaus. To make sure your reports are accurate and current, review them frequently.

Conclusion

In conclusion, opening a checking account on its own has no noticeable effect on your credit score. A checking account is not seen as a type of credit or debt because its main purpose is to help you manage your daily finances. However, some checking account-related behaviors, such requesting overdraft protection or overdrawing your account, might have an indirect impact on your credit score. Use your checking account sensibly, keep an eye on your credit reports frequently, and take care of any problems right away to prevent damage to your credit history in order to preserve a strong credit profile.